CRISIL has reaffirmed 'AA-/Positive/A1+' ratings on the bank facilities and the commercial paper programme of Solar Industries India (SIIL; part of the Solar group).

The ratings continue to reflect the group's market leadership in the domestic explosives and detonators industry, strong operating efficiencies, and a healthy financial risk profile marked by strong cash accruals and moderate gearing. These rating strengths are partially offset by sizeable, albeit declining, customer concentration in revenue profile and susceptibility to adverse regulatory changes.

The Solar group is undertaking substantial investments in manufacturing capacities, which will cater to the defence sector; returns from these investments will be a key monitorable.

For arriving at its ratings, CRISIL has combined the financial and business risk profiles of SIIL, its subsidiary, Economic Explosives (EIL; rated 'AA-/Positive/A1+) and other operational subsidiaries, collectively referred to as the Solar group. This is because all these companies, together referred to as the Solar group, have a common management and the same business interests.

For arriving at its ratings, CRISIL has combined the financial and business risk profiles of SIIL, its subsidiary, Economic Explosives (EIL; rated 'AA-/Positive/A1+) and other operational subsidiaries, collectively referred to as the Solar group. This is because all these companies, together referred to as the Solar group, have a common management and the same business interests.

CRISIL believes that the Solar group will maintain its established market position in the domestic explosives industry, and diversity in its revenue profile over the medium term. The rating may be upgraded if the group achieves sizeable revenue growth and improves its profitability, with traction in the defence business. Conversely, the outlook may be revised to 'Stable', if the group undertakes substantial debt-funded capex, or its debt protection metrics and RoCE decline significantly.

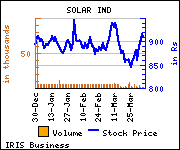

Shares of the company declined Rs 0.1, or 0.01%, to settle at Rs 915. The total volume of shares traded was 2,082 at the BSE (Monday).